Treasury Withdrawal Strategy

I’ve made a mathematical model of the Treasury income for the next 10 years.

Current Treasury yearly income is about 300 million ADA. In 5 years it drops down to 125 million ADA per year. And in 10 years it’s about 40 million ADA.

My thoughts on the Treasury withdrawals as a DRep and Cardano developer:

- I don't mind once a year withdrawals. I think @radioastro made good arguments why this is OK during Cardano Summit presentation on Governance. It's easier to plan, to vote, to hedge against the price volatility, etc.

- I'm against the idea of random withdrawals from the current Treasury. Treasury withdrawals should be sustainable. Thus we need a strategy.

- The Treasury withdrawals should not be staked.

- No voting with Treasury withdrawals

Treasury Withdrawal Boundaries

I propose defining Treasury Withdrawal Boundaries for Cardano's spending model. The budget would be constrained by:

$$Budget \in [50%⋅TreasuryIncome, TreasuryIncome + 20% \cdot Treasury]$$

This approach ensures:

- A flexible budget that adapts to Cardano's evolving needs and market conditions

- Opportunity for Treasury growth during favorable periods

- Sustainable long-term Treasury management with built-in safeguards

Based on current projections, this would make 150M–600M ADA available for the 2025 budget.

The parameters (50% and 20%) are adjustable based on community consensus – for example, a 70%/10% ratio could also be viable.

Cardano Treasury Model

import numpy as np

import matplotlib.pyplot as plt

def calculate_treasury_for_epoch(

fees: float,

current_reserve: float,

tau: float = 0.20,

rho: float = 0.003

) -> dict:

"""Calculate treasury for a single epoch"""

monetary_expansion = current_reserve * rho

rewards_pot = fees + monetary_expansion

treasury_portion = rewards_pot * tau

next_reserve = current_reserve - monetary_expansion

return {

"monetary_expansion": monetary_expansion,

"rewards_pot": rewards_pot,

"treasury_portion": treasury_portion,

"next_reserve": next_reserve

}

# Parameters

INITIAL_RESERVE = 7_660_000_000

CURRENT_TREASURY = 1_600_000_000

WITHDRAWAL_RATE = 0.10 # 10% of remaining treasury each year

EPOCHS_PER_YEAR = 73

YEARS = 10

EPOCHS = EPOCHS_PER_YEAR * YEARS

FEES_PER_EPOCH = 100000 # 100k ADA

# Calculate yearly treasury income

yearly_treasury = []

current_reserve = INITIAL_RESERVE

treasury_this_year = 0

for epoch in range(EPOCHS):

result = calculate_treasury_for_epoch(

fees=FEES_PER_EPOCH,

current_reserve=current_reserve

)

treasury_this_year += result["treasury_portion"]

if (epoch + 1) % EPOCHS_PER_YEAR == 0:

yearly_treasury.append(treasury_this_year)

treasury_this_year = 0

current_reserve = result["next_reserve"]

# Calculate withdrawal amounts and correct treasury balance

treasury_balances = [CURRENT_TREASURY] # Start with current treasury

withdrawal_from_treasury = []

total_withdrawals = []

for i in range(YEARS):

starting_balance = treasury_balances[-1] # Get the last balance

new_income = yearly_treasury[i]

# Calculate withdrawal from treasury (10% of current balance)

withdrawal = starting_balance * WITHDRAWAL_RATE

withdrawal_from_treasury.append(withdrawal)

# Total withdrawal is treasury withdrawal plus all new income

total_withdrawal = withdrawal + new_income

total_withdrawals.append(total_withdrawal)

# Calculate ending balance (only reduced by the 10% withdrawal)

ending_balance = starting_balance - withdrawal # New income is withdrawn, not added

treasury_balances.append(ending_balance)

# Create figure

plt.figure(figsize=(15, 8))

# Create stacked bar chart

years = np.arange(1, YEARS + 1)

plt.bar(years, yearly_treasury, label='New Treasury Income', color='lightblue')

plt.bar(years, withdrawal_from_treasury, bottom=yearly_treasury,

label='Withdrawal from Treasury (10%)', color='coral')

# Add total values on top of bars

for i in range(len(years)):

plt.text(years[i], total_withdrawals[i], f'{total_withdrawals[i]/1e6:.1f}M',

ha='center', va='bottom')

plt.xlabel('Year', fontsize=12)

plt.ylabel('ADA', fontsize=12)

plt.title('Available Treasury Withdrawals per Year (10% of Remaining Treasury)', fontsize=14)

plt.grid(True, linestyle='--', alpha=0.7)

plt.legend()

# Format y-axis labels to millions

plt.gca().yaxis.set_major_formatter(plt.FuncFormatter(lambda x, p: f'{x/1e6:.1f}M'))

# Add text box with parameters

param_text = f'Initial Reserve: {INITIAL_RESERVE/1e9:.1f}B ADA\n' \

f'Initial Treasury: {CURRENT_TREASURY/1e9:.1f}B ADA\n' \

f'Withdrawal Rate: {WITHDRAWAL_RATE*100}% of remaining\n' \

f'Fees per Epoch: {FEES_PER_EPOCH:,} ADA\n' \

f'Treasury Rate (τ): 20%\n' \

f'Expansion Rate (ρ): 0.3%'

plt.text(0.02, 0.98, param_text,

transform=plt.gca().transAxes,

verticalalignment='top',

bbox=dict(boxstyle='round', facecolor='white', alpha=0.8))

plt.tight_layout()

plt.show()

# Print detailed statistics

print("\nDetailed Withdrawal Breakdown:")

print("-" * 50)

for year in range(YEARS):

print(f"\nYear {year + 1}:")

print(f"Treasury Balance at Start: {treasury_balances[year]:,.0f} ADA")

print(f"New Treasury Income: {yearly_treasury[year]:,.0f} ADA")

print(f"Withdrawal from Treasury (10%): {withdrawal_from_treasury[year]:,.0f} ADA")

print(f"Total Available for Withdrawal: {total_withdrawals[year]:,.0f} ADA")

print(f"Treasury Balance at End: {treasury_balances[year+1]:,.0f} ADA")

print("\nSummary:")

print("-" * 50)

print(f"Initial Treasury Balance: {treasury_balances[0]:,.0f} ADA")

print(f"Total New Treasury Income Over {YEARS} Years: {sum(yearly_treasury):,.0f} ADA")

print(f"Total Withdrawals from Treasury: {sum(withdrawal_from_treasury):,.0f} ADA")

print(f"Total Available for Withdrawal Over {YEARS} Years: {sum(total_withdrawals):,.0f} ADA")

print(f"Final Treasury Balance: {treasury_balances[-1]:,.0f} ADA")

Detailed Withdrawal Breakdown:

--------------------------------------------------

Year 1:

Treasury Balance at Start: 1,600,000,000 ADA

New Treasury Income: 303,176,153 ADA

Withdrawal from Treasury (10%): 160,000,000 ADA

Total Available for Withdrawal: 463,176,153 ADA

Treasury Balance at End: 1,440,000,000 ADA

Year 2:

Treasury Balance at Start: 1,440,000,000 ADA

New Treasury Income: 243,755,372 ADA

Withdrawal from Treasury (10%): 144,000,000 ADA

Total Available for Withdrawal: 387,755,372 ADA

Treasury Balance at End: 1,296,000,000 ADA

Year 3:

Treasury Balance at Start: 1,296,000,000 ADA

New Treasury Income: 196,037,077 ADA

Withdrawal from Treasury (10%): 129,600,000 ADA

Total Available for Withdrawal: 325,637,077 ADA

Treasury Balance at End: 1,166,400,000 ADA

Year 4:

Treasury Balance at Start: 1,166,400,000 ADA

New Treasury Income: 157,716,550 ADA

Withdrawal from Treasury (10%): 116,640,000 ADA

Total Available for Withdrawal: 274,356,550 ADA

Treasury Balance at End: 1,049,760,000 ADA

Year 5:

Treasury Balance at Start: 1,049,760,000 ADA

New Treasury Income: 126,942,970 ADA

Withdrawal from Treasury (10%): 104,976,000 ADA

Total Available for Withdrawal: 231,918,970 ADA

Treasury Balance at End: 944,784,000 ADA

Year 6:

Treasury Balance at Start: 944,784,000 ADA

New Treasury Income: 102,230,020 ADA

Withdrawal from Treasury (10%): 94,478,400 ADA

Total Available for Withdrawal: 196,708,420 ADA

Treasury Balance at End: 850,305,600 ADA

Year 7:

Treasury Balance at Start: 850,305,600 ADA

New Treasury Income: 82,384,104 ADA

Withdrawal from Treasury (10%): 85,030,560 ADA

Total Available for Withdrawal: 167,414,664 ADA

Treasury Balance at End: 765,275,040 ADA

Year 8:

Treasury Balance at Start: 765,275,040 ADA

New Treasury Income: 66,446,696 ADA

Withdrawal from Treasury (10%): 76,527,504 ADA

Total Available for Withdrawal: 142,974,200 ADA

Treasury Balance at End: 688,747,536 ADA

Year 9:

Treasury Balance at Start: 688,747,536 ADA

New Treasury Income: 53,648,043 ADA

Withdrawal from Treasury (10%): 68,874,754 ADA

Total Available for Withdrawal: 122,522,797 ADA

Treasury Balance at End: 619,872,782 ADA

Year 10:

Treasury Balance at Start: 619,872,782 ADA

New Treasury Income: 43,369,991 ADA

Withdrawal from Treasury (10%): 61,987,278 ADA

Total Available for Withdrawal: 105,357,270 ADA

Treasury Balance at End: 557,885,504 ADA

Summary:

--------------------------------------------------

Initial Treasury Balance: 1,600,000,000 ADA

Total New Treasury Income Over 10 Years: 1,375,706,977 ADA

Total Withdrawals from Treasury: 1,042,114,496 ADA

Total Available for Withdrawal Over 10 Years: 2,417,821,473 ADA

Final Treasury Balance: 557,885,504 ADA

Why No Staking For Treasury Withdrawals

The Treasury withdrawals should not be staked.

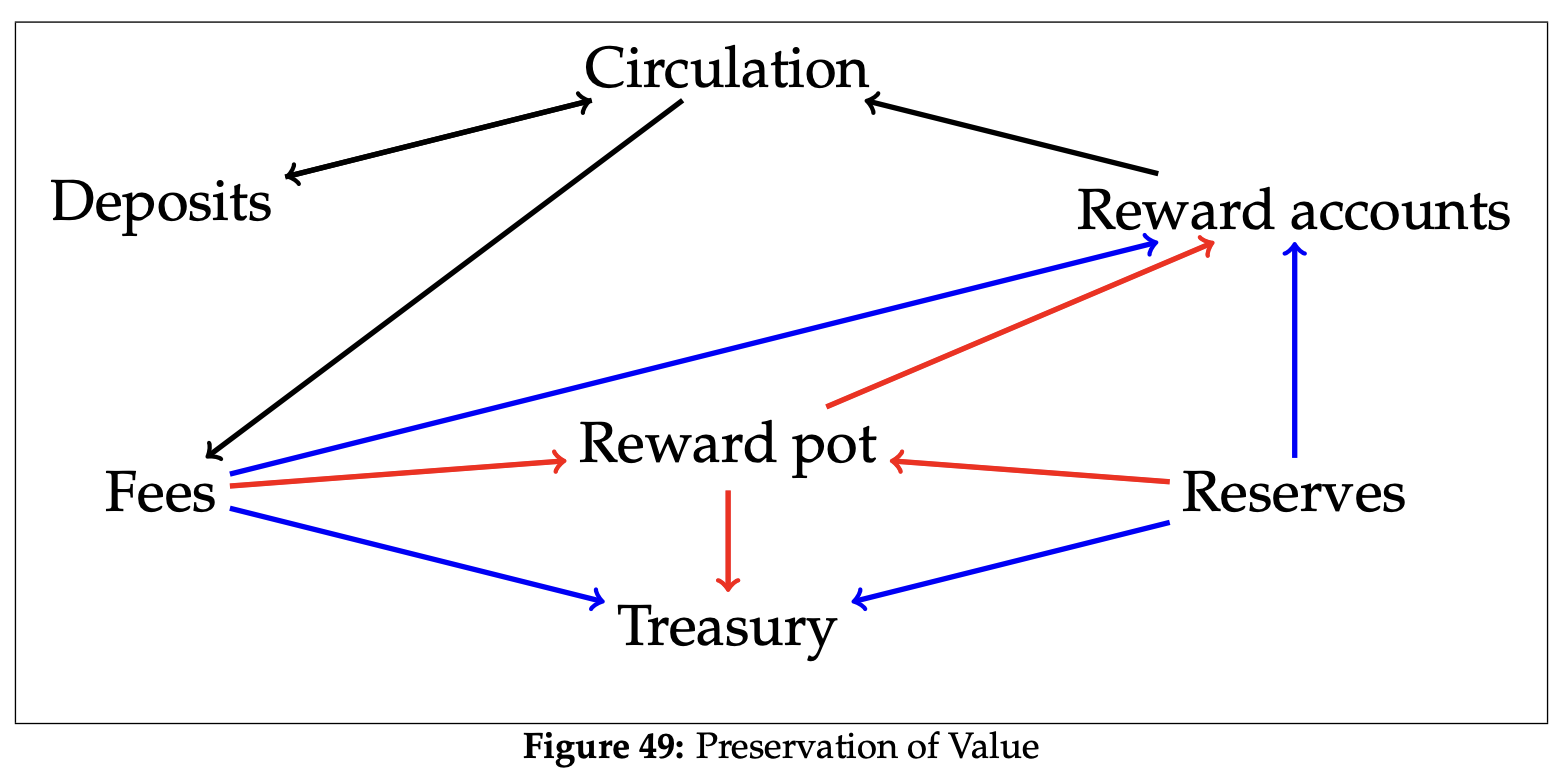

According to Cardano Shelly specification, staking rewards are taken from the Reward pot, which is filled by the Reserves and Fees pots.

When Treasury withdrawals are staked, the rewards are taken from the Rewards pot to Reward accounts. Thus less money goes to Treasury.

This means that by staking the Treasury withdrawals we are decreasing Treasury income, essentially taking money from Treasury twice.

No Voting With Treasury Withdrawals

Well, I think that's obvious. Intersect should not vote with Treasury withdrawals.

Delegate

If you like what I'm doing, please, consider delegating your voting power to me:

CIP-105: drep1k4h4cd5jknvcfeq5uuzqthpl7sdjxrwf9gn25tdk49qxyfhusgm

CIP-129: drep1y26k7hpkj26dnp8yznnsgpwu8l6pkgcdey4zd23dk655qcse26y3g

And vote for our Catalyst proposals! Search LANTR.